If you read the news today about the Goldman all time bonuses, like me, it does not make you want to jump up for joy. I agree with this article here, we bailed out the banks and nobody else. I wrote a thought provoking post about a month ago and I still keep provoking those thoughts.

“Maybe The Real Problem With The Economy Is That It Doesn't Need You Anymore – Opinion”

“When you look at this first paragraph below, there is a smaller number of people needed in many areas, due to technology doing a lot of what we used to do by hand, and again if you have not seen this, take a look around, it’s there. The technology swing in healthcare is just getting started, we will be using more devices and have more information before we get to see our doctors in the future, it is what it is, and some of it is about as intrusive, disruptive and impersonal as it can get, but I don’t think there’s any stopping progress here, so we need to adapt somehow and keep a healthy level of a state of mental well being. That challenge is huge, everywhere.”

“Goldman executives are perplexed by the resentment directed at their bank and contend the criticism is unjustified. Goldman Sachs is on pace to pay annual bonuses that will rival the record payouts that it made in 2007, at the height of the bubble. In the last nine months, the bank set aside about $16.7 billion for compensation — on track to pay each of its 31,700 employees close to $700,000 this year. Top producers are expecting multimillion-dollar paydays.”

Would Goldman short the Health Care stocks to zero if reform goes through? This is a good question and something to think about, really think about. Goldman has the latest version of the Inslaw/PTECH/PROMS software and front runs the market including their own clients, that's how they get their money through software with accelerated business intelligence algorithm and aggregation capabilities.

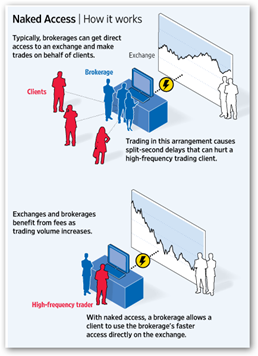

High frequency and flash trading have been the key elements to Goldman’s success, the running of the algorithms. High frequency to us data folks is about like having a T5 line and leasing out space or access and that’s exactly what this is and that comes at a cost, fee, etc. so more money made here for the brokers and no data trail to see who they are as it comes back to a broker’s IP address, no log in, just massive access with servers and computers piled high with Xeon high powered processors to cut out the competition within 1/30th of a second. You can see from the picture on the right there’s one less area for the data to move through as well.

And so what do those big money makers use: Robotic Investing Software and you can buy some robots online, but you can bet it’s not all the proprietary code that Goldman uses.

One company said set your algos and go golf, the robot will do the rest, so that’s how they do it with the right hardware and connections. So this is how they live, set the algos and can spend the rest of the day leisurely or adjust the robot at any time. This is what makes big bonuses, basically wagering.

Back to healthcare, I noticed about six hospitals in the news today with layoffs and one in New England closing. Next question, what happens when the folks that run the robots need healthcare, do they think about it? Why are their executives perplexed with thoughts of resentment and anger from the rest of us? They can’t figure that out? Health insurers do the same thing, it’s in the algos and we need to get up to par and have an SEC with enough business intelligence to audit and find the “dark pools” before we all become members of someone’s dark pool of another kind. BD

A survey of the nation’s top CEOs indicates business conditions are improving. I don’t know about you, but I’m not feeling it. So who, exactly, is benefiting from the bullish outlook?

If you work for Goldman Sachs, which today announced quarterly profits of $3.2 billion while setting aside $5.4 billion for compensation, you’re a happy camper. But if you’re among the 9.8 percent of Americans that are unemployed - a 25-year record - you’re probably not in the mood to celebrate just yet.

It sort of makes you wonder. Just a year after a near collapse of the entire banking system, bankers are making record profits and compensation while the rest of the nation has record unemployment. Moreover, reports from the Recovery Accountability and Transparency Board (as reported by the Wall Street Journal) indicate that the vast majority of stimulus funds have yet to be spent and the number of jobs added or saved is relatively moderate.

I could be wrong, but it’s starting to look like we bailed out the banks and nobody else.

The Banks are Recovering - Are You? | The Corner Office | BNET